Highlights

- Bitcoin Hashrate seems to have seen an unexpected drop this week

- This drop was followed by a sudden fall in price, from $10,800 to

mid $8,000

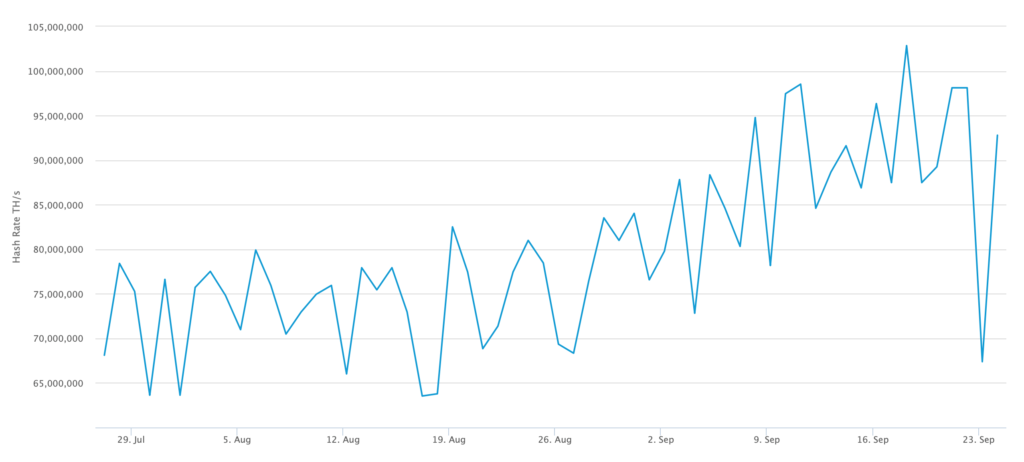

Bitcoin’s hashrate, which recently saw all time

highs, has unexpectedly seen a sudden unexplained drop this week. The hash rate

fell from more than 98 million TH/s to a merger 57.7 million TH/s. This is

according to the data from Coin.Dance, a statistic website for Bitcoin. This drop was a whooping 40% of

the network’s entire hash rate.

Source: Bitinfocharts.com

The drop almost had minute to minute correlation

with the unveiling of Bakkt, a bitcoin based futures platform formed under the

shadow of the NYSE. A few days later, on 24th September, 2019, we saw a

flash-crash by bitcoin, jumping straight from $10,800 to its current range of

mid $8,000.

Some

have cited the drop of the hashrate as one of the two major reasons for the

recent Bitcoin

flash crash,

while others cite the crash as a dislike against the launch of Bitcoin futures

trading on Bakkt which has not been very successful yet.

The biggest theory surfaced was the closure of at least 45 huge mining farms in Kyrgyzstan by the national Government. This bold move was taken as the government saw unexplained demand in electricity, which was eating up all the resources and reserves of the country. Kyrgyzstan is host to several remote mining platforms, . The drop occurred just hours to the launch of the much-anticipated Bakkt platform.

The post Bitcoin’s Hash Rate Plummets Days Before the Pullback appeared first on Cryptoverze.